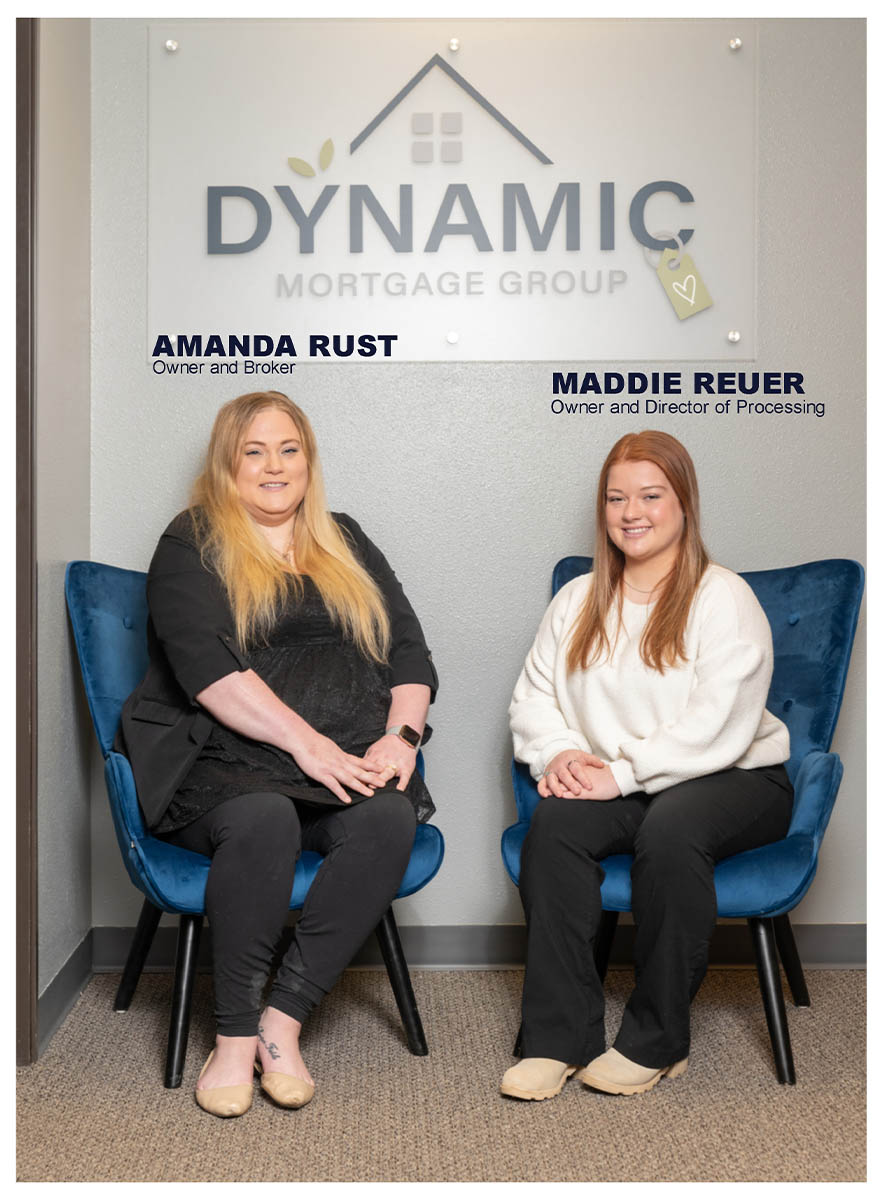

Dynamic Mortgage Group is a locally owned and operated mortgage brokerage company with a cause. Founded by Maddie Reuer and Amanda Rust in February of 2022, the two forged a new path in the mortgage industry to make a name for themselves and play by their own rules for the customer. I sat down with Reuer and Rust, co-owners of Dynamic Mortgage Group, to discuss affordable homeownership and how they’re working to make it a reality, the duo’s future ambitions, and much more.

Reuer and Rust have always been in the market for a career position that serves others before themselves. Rust initially pursued a degree in psychology, recognizing its value in truly understanding and assisting others, no matter the field. After deciding that she wanted a change of pace, Rust immersed herself in the world of finance, as she saw an opportunity to make a difference through customer service and going above and beyond the standard for customers.

“I wanted to pursue the field of mortgage someday, but that’s a hard field to get into. Luck would have it that somebody local was hiring a junior loan assistant, so I got my foot in the door through that position and started at the bottom of the totem pole. I loved the position and industry as a whole, but I was hungry for more,” Rust said.

“I loved the ability to go the extra mile for others in my position, so I questioned why we weren’t doing this for every person that came to us for help. I didn’t want to just be doing things for the money; I wanted to help people. I decided to pivot and start Dynamic Mortgage Group, which is where I hired and met Maddie. Maddie was on the same page as me, which is why we’ve gotten along so well.”

Reuer worked in customer service for SCHEELS in college. Wanting something more at the time, she sought out a customer interaction-heavy position that would help her grow as a person. “It’s helped me learn how the world works for different varieties of people and how they handle the very stressful topic of mortgages,” Reuer said.

Reuer and Rust broke off from their former positions to form Dynamic Mortgage Group with certain benchmarks and standards in mind for their customers, including being available 24/7. It’s evident based on their company benchmarks and goals, as well as their ethics and standards, that they aren’t in this business for the money.

“We’re not transactional people. In fact, we make very little money compared to most in our industry. Dynamic Mortgage Group’s whole point has always been to give everybody a chance at affordable housing. We invest everything that we get right back into the company. Our main goal was and is to have integrity, which is, unfortunately, lacking in many mortgage brokerages,” Rust said.

“We’re in a male-dominated industry, completely local and self-funded, just trying to do the right thing for people. We sat together and spent hours coming up with a name, logo, and what we were going to stand for. We always came back to simply doing the right thing and ensuring that people are never alone during this process.”

Home Ownership and Mortgage Tips with Dynamic Mortgage Group

1. Don’t Get Discouraged.

“It’s going to be a long and scary process, but you have to trust both it and people along the way. It can be difficult, but second opinions make a great difference. I encourage everybody to shop around if you can find somebody with a better rate than us. We’re still super happy that you got a better rate, because our first offer will always be our best offer.”

2. Advocate for Yourself.

“Ask questions. If you go somewhere and they tell you, ‘This is the program that I’m going to put you in and it has this amount of extra fees added to it,’ you should speak up and say if you feel this isn’t the best program for you. Don’t let anybody tell you which route to go if you aren’t comfortable with your payments. It’s okay to say you aren’t comfortable with a $3,000 payment, and $1,500 payments might be more in your price range.”

3. Find Somebody Local.

“All of our money goes back into our local economy when you work with us. Rather than spending money with a random person down in Texas to do your mortgage, your money can go back into our community when you shop locally.”

4. Don’t Underestimate Yourself.

“If something doesn’t feel right and you want to make a difference for the better, you have to be the difference. You cannot sit and wait for things to change. You have to change because there are a lot of followers in this world. There are not a lot of doers and the world indeed needs both, but some are doers that want to make a difference.”

The duo behind Dynamic Mortgage Group has a proven track record of going the extra mile for their client base, especially when they need it most. Their reasoning for going that extra distance stems from past industry experiences that have been less than satisfying for the two of them.

“One of our clients was a veteran, and their closing date kept getting moved multiple times. Maddie and I were working on this case together, and the broker ultimately in charge kept saying that if we wait longer, then we could charge more commission, and that didn’t sit well with us. Even others were noticing that it wasn’t the right fit for us. We decided that we’d be at our happiest if we were doing this for ourselves and our clients, rather than someone else with different motives. We were terrified at first, but we knew that we could do it,” Rust said.

While admittedly intimidated by forging a new path, the two weren’t alone. “My dad owns a business as well, so he had a hand in the encouragement behind launching Dynamic Mortgage Group. He always told us that it’s not going to be an overnight thing and that we need to buckle down and continue doing what we do. That advice has helped push us to places that we didn’t think we could achieve. We’re doing things now that we never would’ve imagined achieving,” Reuer said.

While Rust and Reuer bring significant past experience to the table, Dynamic Mortgage Group is still a relatively new company, having been founded in February of 2022. That being said, they have high benchmarks for growth in the coming years. Within the next year, Rust and Reuer anticipate an expansion to other states, including Arizona, Montana, and South Dakota. However, they vow to continue having their primary focus on North Dakota and the community that they’re proud to call home.

“In terms of how far we’ve grown, we’ve added so much to our profile of what we offer. When someone has come to us requesting a loan that we don’t offer, we do the research to get an offer to them, or at least get them in the right direction. While we want to continue to grow beyond North Dakota, this state will always be our main focus. We go out and volunteer, and truly enjoy having that community focus,” Reuer said.

Going Above and Beyond

“One of our clients, originally from outside of the United States, was trying to find a home. There were a bunch of hoops that we had to jump through, one of them being his taxes done the year prior. Some of his income wasn’t counted in what we were using to approve them for a loan, and we needed all of the tax details. Amanda and I went to his work to have him sign a form. When we got there, he was up in a forklift. After he quickly got down and signed the document, we went to the state capitol’s tax office and got the paperwork we needed. After we did everything to close on the home loan, we shared a few tears in the lobby. We were so excited to finally have what we needed to get them moving forward on a home. We definitely take a more 'everything is for the client' approach. If there's something that we can do on our end to make anything easier, we’re taking that extra step. We are calling our clients off forklifts to get documents for them. We’re doing everything in our power to help our clients and determine if they’re financially ready, or if they’re in over their heads a bit. We’ll have those necessary conversations if their budget is a little tight, or just make sure that they’re aware of pricing. After all of that, we’d do it again in a heartbeat. We’d go to the hypothetical, or literal, capitol for any of our clients.”

- Maddie reuer & amanda rust Tweet

Dynamic Mortgage Group offers 22 different lenders that they work with nationwide. Their plan, originally, was to remain small with five to six lenders and target their focus on a small handful of programs. Instead, they made the decision to grow and shape themselves to their clients’ needs. While the process can be daunting, Rust and Reuer emphasize that you’re not going through it alone, as you have two seasoned professionals by your side to help in any way.

“We’ll work with you every step of the way because we don’t ever want you to feel alone. Even when you come into our office, you’ll see two couches in my office, rather than a corporate headquarters conference room setup, because that’s where people are most comfortable. So, why not have a drink, sit on the couches, and discuss an application?” Rust said.

“We want to always leave any person that we work with satisfied, as that’s always going to come first to us. We almost look at ourselves as mortgage counselors, more than brokers, because we do so much more than brokering. Rather than simply picking a rate, we genuinely want to help in any way that we can.”

As Reuer and Rust blaze a new trail in the mortgage industry, the two ensure that their clients are in safe and protective hands when working with them to become a homeowner. While it can be an intimidating path, especially for a first-time homeowner, Rust and Reuer are there to guide you along every step of the way

“Our slogan for the business is ‘Let’s grow together.’ We want to help you, grow with you, and answer any questions you may have before, during, or after the process. If you buy a house with us, and then you want to buy another house 15 years later, we want to help you with that and grow with you. We’re here for the client. We’re not in it for the money,” Reuer said.

“We just want people to get into a house, as that typically leads to a healthier community. Our main business plan was to make homeownership more obtainable. As I said before, healthier communities usually have higher homeownership levels. Our goal is to create a healthier community, not just for now, but for the future, as our way of giving back. Helping people get into a house should be something that everybody deserves. Everybody should have a warm, safe house to sleep in at night.”

Dynamic Mortgage Group

(701) 751-0932

dynamicmortgagegroup.com

[email protected]

/dynamicmortgagegroup

NMLS #2296131