Chad Wachter, a Bismarck native with a passion for entrepreneurship, is a fifth-generation business owner. From a young age, Wachter had a strong entrepreneurial spirit and was determined to make a mark in the business world. After high school, he founded Investcore, Inc., a real estate company focused on developing and investing in the highest-quality residential, multi-family, single-family and mixed-use projects in North Dakota.

Today, Wachter’s impact can be seen across a range of businesses, including Investcore, Inc., Wachter Development, Inc., Trademark Realty, Inc., Bismarck’s Big Boy Restaurant, the Blarney Stone chain, the Hotel Donaldson in Fargo and more. Over the past 30 years. Wachter’s success has only continued to grow, making him a prominent figure in the Bismarck-Mandan area. In a recent interview, Wachter shared insights into his upbringing, his family’s impact on him and Investcore’s current projects, offering a unique look into his entrepreneurial journey.

Generations of Wachter Family Ventures

The Wachter family has had an extensive presence in and impact on the Bismarck-Mandan community for numerous decades, bringing to life different projects and ventures that have stood the test of time.

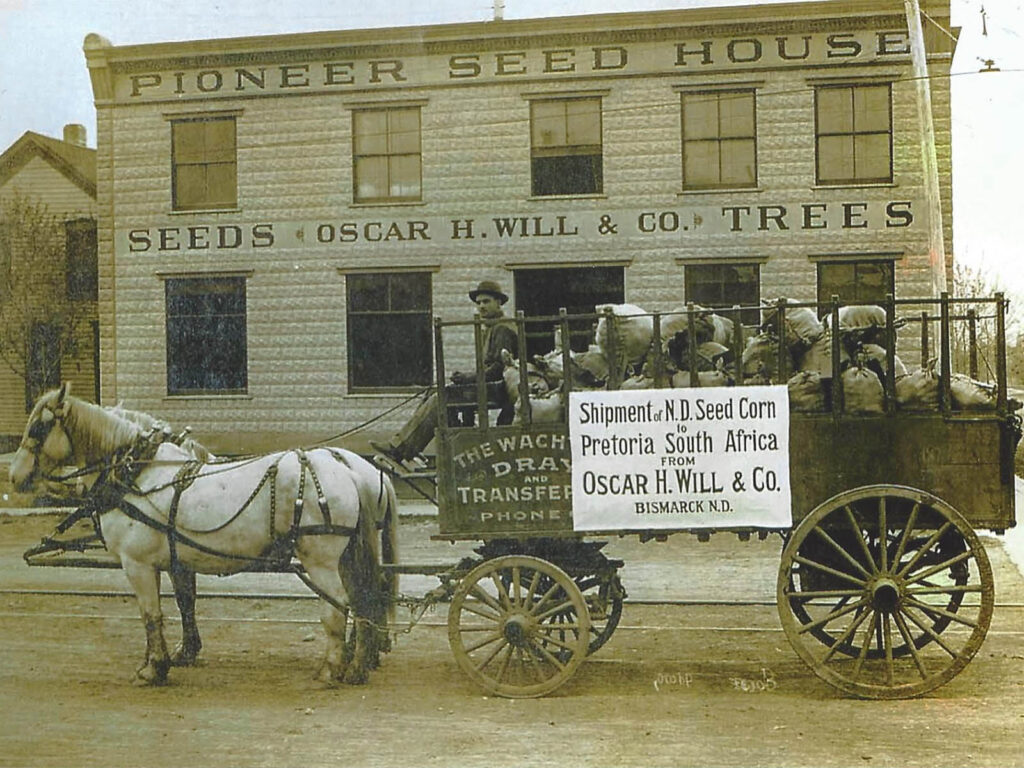

For example, we used to unload the paper for the Bismark Tribune and store it in our warehouse facility in Bismark, along with food, liquor, paper, tobacco and other products for other local businesses, then deliver it as needed.”

-Chad Wachter

Timeline of the Wachter empire throughout the years

1885 – Wachter Ranch

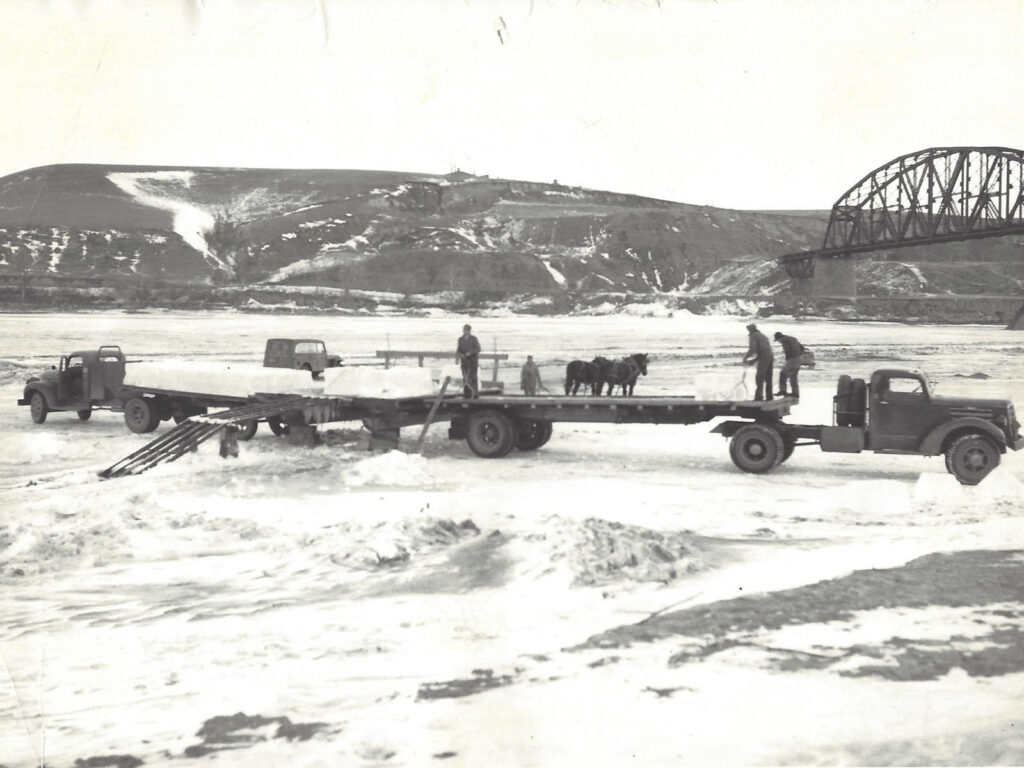

Wachter Dray and Transfer Corp

1929 – Wachter, Inc.

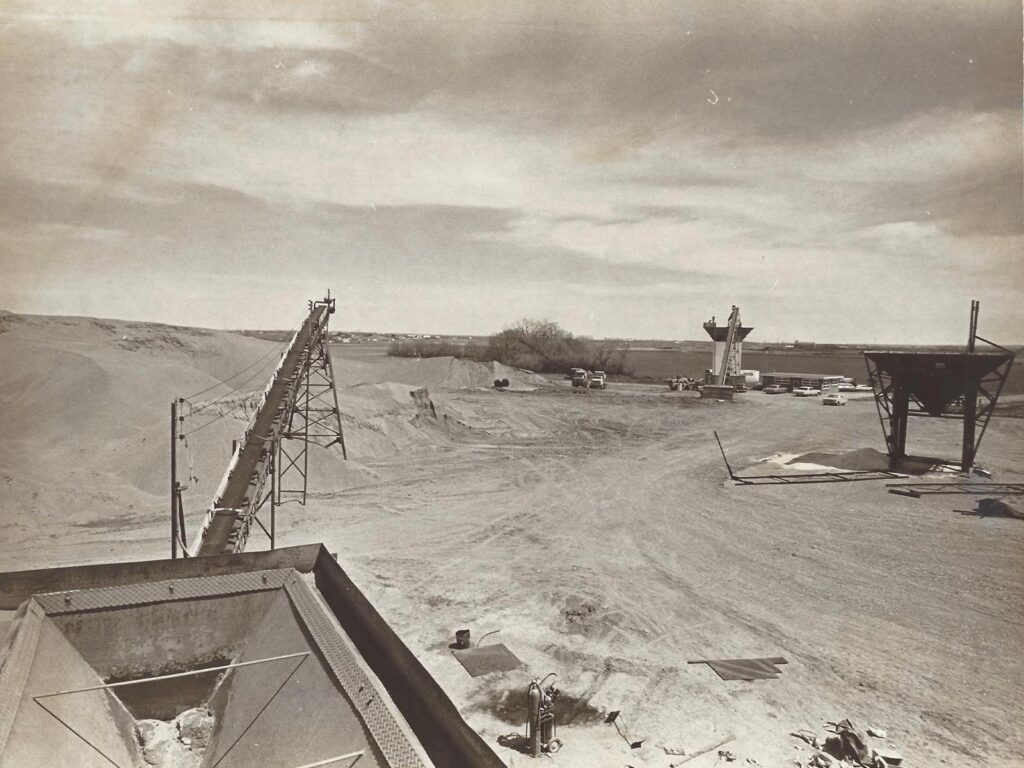

1946 – Dakota Sand and Gravel Co.

Wachter Development, Inc.

Did You Know?

With roots in farming and ranching, the Wachter family had one of the largest contiguous ranches in the Midwest until around 1983, with 28,800 acres.

Throughout our journey, we have been fortunate to gain valuable experiences across a broad range of industries, including hardware retails, hospitality, food and beverage, banking, real estate development, construction, transportation, ice cutting, storage, insurance, mining, real estate brokerage and homebuilding.”

-Chad Wachter

1950 – One For All Products

1953 – Bismark Big Boy

1970 – Kirkwood Plaza Shopping Center

1973 – Sky Corp

1974 – Bank of Kirkwood Plaza

At one point, our family businesses employed close to 800 individuals in Bismarck. However, in the 1980s, my family made the decision to split our companies due to differing ideas and perspectives. This can often be a challenge in family- owned businesses.”

– Chad Wachter

1974 – Kirkwood Data Processing, Inc.

Kirkwood Hardware Hank

Kirkwood Motor Inn

Earth Builders, Inc.

Kirkwood Office Tower

Chad Wachter’s History

Chad Wachter has deep roots in the business world, having grown up working for various family companies owned by his father. These companies spanned a wide range of industries, including banking, construction and real estate, encompassing businesses such as hardware stores, shopping centers and hotels.

“My father has been a major influence on my career, providing me with numerous learning experiences and opportunities to work in different areas of the family business,” Wachter reflected. “These experiences have exposed me to a diverse range of business operations and taught me valuable lessons that I carry with me today.”

Wachter’s journey in business began in the construction industry, where he started working in the family’s concrete business. He gained hands-on experience in pouring concrete for basements, footings, walls, driveways, sidewalks and more. This led to a summer working for one of the family’s gravel mining operations near Riverdale, ND, where he gained a deeper understanding of the concrete industry and learned important skills that would serve him well in the future.

During that summer working for one of his family’s gravel mining operations, Wachter learned about the importance of owning raw materials for the concrete business. “I learned that if you don’t own the aggregate, your profits aren’t worth it,” he said.

After this experience, Wachter shifted his focus to the financial side of the business, working in the finance division of his father’s construction and real estate development companies. He worked closely with accountants and gained valuable experience in accounting, finance and cash flow management. “I’ve always preached to people in business or aspiring to be in business that they need to understand accounting. You need to understand how much money you’re making, how much you owe in taxes and where your cash flow is going,” Wachter said.

Wachter left college after just one semester to focus on entrepreneurship and real estate development. “My dad encouraged me to learn the real estate development business,” he said. “For me, real estate development is about buying raw land and putting in infrastructure and streets, then selling the property to someone else to build houses, apartment buildings or other types of mixed-use property.”

Wachter has been a mentor to many and has always emphasized the importance of a solid understanding of finance and accounting in business. He has used the lessons learned from his early experiences to shape his successful career.

1976 – Tower Insurance

1977 – Lancelot Realty

Towne and Country Liquor

1978 – Kirkwood Sportsman

1979 – Exclusively Patrick’s

In his early 20s, Wachter took his real estate development company Investcore, Inc. and set out to bring it to the next level.

The Growth of Investcore and What’s Next

With Investcore, Wachter is a well-known name in the real estate industry. He started his journey on his own with Investcore, purchasing a few tax-lien foreclosure properties south of Bismarck. With an estimated cost of $10,000, Wachter transformed these properties into 50 single-family lots worth approximately $1.5 million in just two years, including a development titled Falconer Estates, named after the former family who owned the property.

Wachter’s early days in real estate were marked by option agreements, where he explored the potential for making money by controlling large pieces of property for a small down payment. “There is a ton of money to be made in real estate option agreements. You just put a certain amount of money down for the seller to keep for the right to purchase their property by a certain date,” Wachter said.

Investcore has come a long way from its early days, and now the company is gearing up for its next big project—a 2,000-acre development that’s set to take place over the coming decades. The company’s current project is a 4,500-unit development over the next 25 to 30 years, with an average unit price of $400,000, making it a $1.8 billion project.

Wachter’s children are following in his footsteps and becoming a part of the family business. Derek, his oldest son, studied entrepreneurship at the University of North Dakota, and Kayley, his daughter, is currently studying entrepreneurship there as well. His youngest son, Preston, is studying business at the University of Minnesota Morris. Wachter stated that he is proud to have his children involved and feels it is a privilege to pass down his knowledge and passion to the next generation.

Wachter’s real estate brokerage firm, Trademark Realty, has been in operation since 2005. It has 41 agents who help people in the Bismarck-Mandan area buy and sell properties. This company has proven to be an asset for Wachter, as he has been able to sell his developed properties through Trademark Realty. The company also works with builders who have bought land from Investcore, assisting them in selling their homes by using the Multiple Listing Service (MLS) system.

Wachter’s approach to his real estate business involves working closely with homebuilders. The company’s lot inventory is sold to these builders, who then sell their newly built homes through Wachter’s real estate brokerage firm, Trademark Realty. Beyond just selling homes, Wachter and his team also offer construction loans and funding for other projects, giving Wachter the opportunity to indulge in another one of his passions. “I enjoy that aspect of the business because it gives me a bit of that banking and lending experience that I’ve always wanted,” he said.

1980 – Checkmate

1981 – Prairie Schooner

1982 – Cork and Bottle Liquors

1983 – Cottonwood Lake Development

1984 – Expressway Inn

Impressive Volunteering Efforts

As a Bismarck resident and community leader, Chad Wachter has made a significant impact through his involvement with local nonprofits. Recently, Wachter played a key role in raising funds for a new hockey facility in the city. This accomplishment is just the latest example of Wachter’s dedication to improving the community. In addition, Wachter has formed a partnership with Bismarck Public Schools to offer students real-life experience in the housing industry. The profits from this partnership will go toward creating student scholarships, furthering Wachter’s mission to invest in the future of Bismarck’s youth.

Outside of the various facets of Wachter’s businesses, Investcore has a multitude of projects happening across the country. While the company’s current focus is a 4,500-unit development in Bismarck, it also has smaller projects in Las Vegas and Minneapolis.

As 2023 begins, Wachter has set his sights on improving and maintaining Investcore’s current portfolio. He plans to take a closer look at the company’s operations to make them more efficient, rather than starting new ventures.

Wachter’s long-term vision for Investcore includes continuing to develop properties in the Bismarck-Mandan area, where he has lived his entire life and has a strong understanding of the local economy. Although he plans to invest in other regions of the United States, he intends to be more cautious in these areas, as he believes it’s important to have a good feel for the region in which one is investing.

Wachter’s real estate brokerage company, Trademark Realty, is also a part of this vision for the future. With 40 agents, Trademark Realty has helped Wachter sell properties he has developed and also assists other builders in selling their spec homes. Wachter aims to continue to provide this valuable resource for the Bismarck-Mandan area and beyond. Outside of the real estate industry, Wachter has also developed a passion for the world of hospitality and restaurants.

Wachter has a passion for the hospitality industry and has plans to expand his portfolio in this sector as well. With over six years of experience owning Bismarck’s Big Boy restaurant, Wachter has set his sights on opening more Big Boy locations throughout North Dakota. However, due to the impact of the COVID-19 pandemic, these plans have been temporarily put on hold to ensure financial stability.

Wachter’s involvement in the hospitality industry has led him to partner with Jim Poolman and Dr. Dustin Hollevoet on the Blarney Stone Restaurant chain, which has locations in Bismarck, Sioux Falls, West Fargo and downtown Fargo. He considers this partnership to be one of the most rewarding experiences of his career.

Wachter considers the acquisition of the Hotel Donaldson in downtown Fargo to be a “dream come true.” The historic building was purchased in partnership with his good friends, Jim Poolman and Dr. Dustin Hollevoet, making it an even more special and rewarding experience for Wachter. He stated that he feels privileged to have the opportunity to own such a landmark and work with close friends at the same time.

1984 – WW Noodles

1992 – Invescore, Inc.

Microvest, Inc.

1993 – Falconer Estates

“Partnerships are not something I usually pursue, but this one is different,” Wachter said, referring to his partnership with Poolman and Dr. Hollevoet. “I have great respect for both of them, both as individuals and as successful business people. It’s been a truly rewarding experience.”

As for his passion for the restaurant and hospitality industry, Wachter sees it as a fun and straightforward business. “The formula for success in the hospitality and restaurant industry is simple,” Wachter said. “All you need is a good location, great service, delicious food and reasonable prices. I appreciate that my partners in these business ventures understand and agree with these fundamental elements of success in the industry.”

Chad Wachter’s Active Board Roles

Wachter currently serves on these boards:

- University of North Dakota Alumni Association and Foundation

- Bismark State College Foundation

- Bismark Industries, Inc.

- Lewis and Clark Development Group

- Sanford Health Bismark

1997 – Badlands Grill and Bar

House of Bottles

Chad Wachter’s 5 Tips for Aspiring Entrepreneurs

1. You have to be willing to put in the time.

Being an entrepreneur requires a lot of hard work, dedication and a willingness to put in the time. You can’t expect to be successful overnight, and there will be long hours and late nights. But if you’re willing to put in the effort, the rewards can be significant. Remember, success is not a destination, it’s a journey. Building a successful business takes time and effort, but the rewards are well worth it. Don’t be discouraged by setbacks or obstacles along the way, and keep pushing forward. Successful entrepreneurs are those who are willing to put in the time and effort to make their dreams a reality. So, roll up your sleeves and get to work!

2. It’s important to have a really good accountant or somebody to give you good tax and financial advice.

Taxes are the largest expense you will face. Having a knowledgeable and experienced accountant or financial advisor is crucial for any entrepreneur. They can help you navigate the complex world of taxes, bookkeeping and financial planning so you can focus on growing your business. A good accountant can also help you identify areas where you can save money and make smart financial decisions that will benefit your business in the long run. They can also provide valuable insights and advice on investments, business structure and tax planning strategies. Don’t try to go it alone when it comes to your finances. Having a trusted advisor on your side can be a game changer and can help you avoid costly mistakes. Invest in a good accountant or financial advisor and you’ll be well on your way to achieving financial success.

3. When borrowing money to finance your business, it’s essential to focus on financing growth, not losses.

If you find yourself in a losing position, it’s better to make the necessary changes to stop the losses, rather than constantly extending your debt through a loan or line of credit.

1999 – Prairiewood Estates

2001 – Classic Designer Homes, Inc.

2002 – Southridge Development

2004 – Trademark Realty

WW Investments, LLP

4. Having a good understanding of accounting and finance is crucial for any business owner.

Investing in a record-keeping system, like QuickBooks, can help you track your finances and understand where your money is going. To improve your financial literacy, consider learning about accounting and finance through resources like YouTube videos, books or seminars. You don’t need a formal education to gain a good understanding of these concepts, but doing so will help you make informed decisions about how to grow your business and increase your profits.

5. Starting a business can be a challenging and rewarding journey, but it’s important to be mindful of your personal finances.

During the early stages of your business, it’s best to live modestly, as if you’re still broke. This will help you avoid overspending and help maintain financial discipline. It’s common for entrepreneurs to get into trouble when they can’t control their expenses, especially after they start generating income. Avoid the temptation to make big purchases, such as a new vehicle, house or other luxury items, until your business is established and secure. By maintaining a frugal lifestyle in the early stages of your business, you’ll be better positioned to achieve long-term financial success.

What is Investcore, Inc.?

Investcore Inc., a Bismarck, ND-based land subdivider, is making waves in the North Dakota real estate industry. The company specializes in subdividing land and creating new residential and mixed-use communities in the Bismarck area. With a focus on delivering high-quality projects, Investcore is dedicated to transforming the local landscape one development at a time. Whether it’s creating new homes for families or expanding the city’s commercial offerings, Investcore is committed to supporting growth and improving the quality of life in Bismarck and the surrounding areas.

2005 – Santa Fe, LLP

2011 – Triton Homes

2017 – Big Boy Restaurant

2018 – Silver Ranch Development

2020 – Blarney Stone Pubs

Looking Ahead in 2023: A Real Estate Outlook from Chad Wachter

The commercial real estate market in Bismarck is expected to face challenges throughout the year 2023. With a large number of vacant commercial buildings and the ongoing trend of remote work, the commercial and retail sectors are undergoing a redefinition. This has resulted in many retail businesses turning to the e-commerce model, like Amazon, for their sales.

The commercial real estate market is expected to struggle this year, particularly with the recent interest rate hikes. These hikes affect the commercial retail real estate market more than the residential real estate market, as the rates for each category are tied to separate rate indexes.

On the other hand, the residential real estate market in Bismarck is facing a shortage of inventory, with only about 100 residential units for sale at the moment. This is about a third of the normal supply level for the city, leading to little decline in prices for homes. However, the industrial real estate market, such as shop condos and warehousing, remains stable, as does the multifamily market.

An interesting shift in the real estate market is the inverted cycle, where renters can now pay less than the cost of a mortgage payment on a home. This is expected to fuel the apartment residential rental market. The construction of more apartment buildings is also likely, although the cost of building is now higher.

I refer to 2023 as the “reset year,” as prices are expected to come down and homebuyers will face more realistic mortgage rates. The typical mortgage rate is now expected to be between 5.5% to 6.5%, compared to the previously low 2.5% rates. This year will be an exciting one for the real estate community, as the impact of the new interest rates on the real estate market will be closely watched.

1980 – Hotel Donaldson

2023 – Blarney Stone in Hotel Donaldson

Contact Investcore, Inc.

Phone: 701.223.2200

Website: investcore.com

Linkedin: linkedin.com/company/investcore-inc

Address: 4614 Memorial Hwy, Mandan, ND 58554